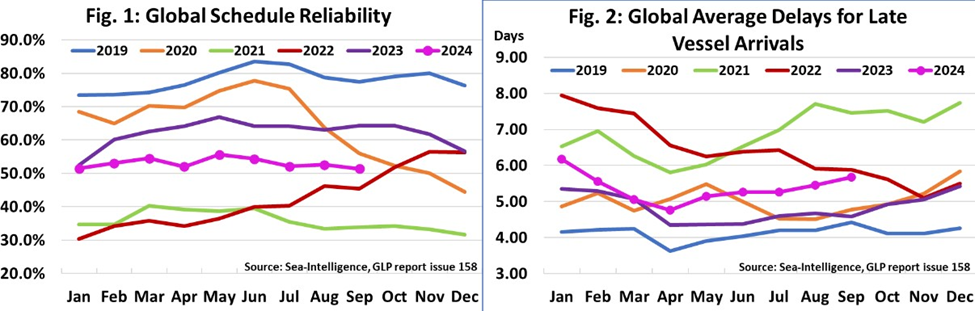

As Christmas Festive approaches fast, logistic stakeholders need to know about the condition of the global ocean shipment. As per Sea Intelligence latest info, in September 2024, global schedule reliability declined by -1.2 percentage points M/M to 51.4%. While schedule reliability in

2024 has stabilized within the 50%–55% range, it’s been on a slight downward trend since the May peak..

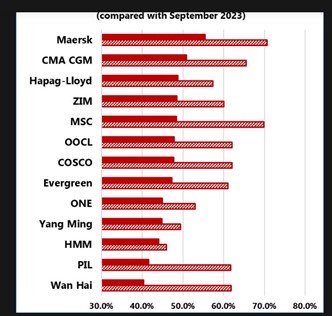

Another important piece of the ocean shipment is the performance of carriers. As per Sea Intelligence report (disclaimer: this is average of performance, every trade lane has different),

Maersk was the most reliable top-13 carrier in September 2024 with schedule reliability of 55.5%. CMA CGM followed with schedule reliability of 50.9%, as the only two carriers above the 50% mark. The remaining 11 carriers were all in the 40%-50% range. Wan Hai was the least reliable with 40.4% schedule reliability. Only four of the top-13 carriers were able to record improvement in schedule reliability in September 2024, with PIL recording the largest increase of 4.5 percentage points, and HMM recording the largest decline of -7.8 percentage points.

Latest News

The situation of ocean shipment also influenced by others factors, especially the factors that cause congestion. This news will inform 4 issues. Two issues for causes of latest congestion (despite Red Sea Conflict) and the rest will inform the issues that potentially cause next congestion problem.

1. Typhoon creates congestion at Shanghai, Ningbo, Shekou, and Kaohsiung

Asian container ports are facing delays due to Typhoon Kong-Rey, the strongest typhoon to hit Taiwan since 1996. Ports in Kaohsiung, Shanghai, and Ningbo are experiencing significant congestion, with Kaohsiung seeing 100% delays for 69 ships arriving this week, while delays in Shanghai, Ningbo, and Shekou stand between 82%-85% respectively. Ships arriving over the weekend, such as ONE’s Contship Era and YM Wreath, faced berthing delays of over 24 hours.

Typhoon-related disruptions have led to five-day dwell times for transhipments and six for exports. Linerlytica reports elevated vessel queues in North Asian ports due to adverse weather, predicting that congestion will clear in the coming days, though more delays are expected.

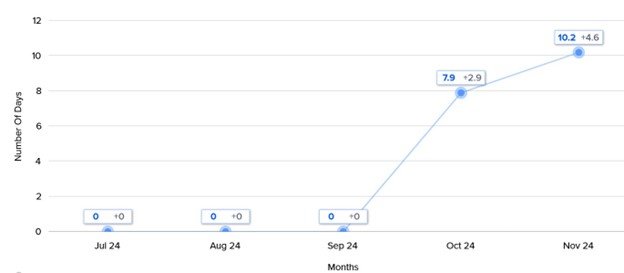

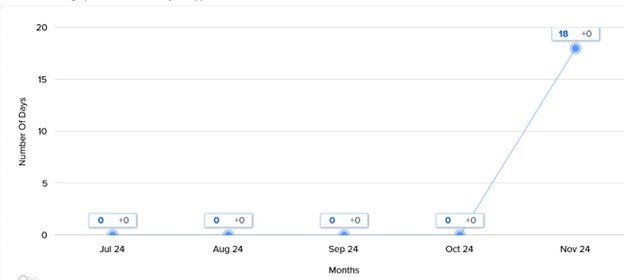

Our internal system (monitoring for congestion) also confirms this congestion for these trade lanes. Worse, the congestion in one port will have a domino effect on other ports. It means, in fact, we have to add another day for the delay in the shipment plan. Here is the profile of the delay from those 3 trade lanes.

Ningbo-Jakarta

Ningbo-Jakarta trade lane congestion in November 2024 indicates better than in October 2024 (from an average 9.9-day delay to a 7.5-day delay). However, in the shipment plan, we have to also consider adding more days as the previous mention that one port congestion will affect other ports. It means the sum of delay days will be growing.

Shanghai-Jakarta

Shekou (Shenzen) -Jakarta

Kaohsiung-Jakarta

The situation is getting worse in Shanghai, Shekou, and Kaohsiung. The graph shown indicates the delay gradually increasing.

2. Labor Strikes at Key Canadian Ports

The recent labor strikes at major Canadian ports, including Vancouver and Prince Rupert, have created significant disruptions in North American trade, affecting around $800 million in daily cargo flow. The strikes, led by the International Longshore and Warehouse Union (ILWU) Local 514, come after extended contract disputes with the British Columbia Maritime Employers Association (BCMEA) and involve unresolved issues around job security amidst rising automation.

With limited capacity at U.S. ports like Los Angeles and Long Beach—already burdened by longer wait times due to recent issues—vessel diversions could exacerbate congestion across the West Coast. Industry leaders, including Alan Baer from OL USA, warn that transferring cargo to alternative routes may lead to further delays, increased costs, and diminished efficiency for supply chains reliant on timely goods delivery.

For the initial guidance, here is the latest condition regarding port congestion around the world:

| Region | Port | Situation |

|---|---|---|

| North America – West Coast | Vancouver | Bad congestion due to labor strike |

| Los Angeles | 2-3 days delay at port, no issue with trucking (Inland) | |

| Long Beach | 2-3 days delay at port, no issue with trucking (Inland) | |

| North America – East Coast | Montreal | Medium congestion due to labor strike |

| New York | 3-5 days delay at port, no issue with trucking (Inland) | |

| Savannah | 3-5 days delay at port, no issue with trucking (Inland) | |

| North America – Mexico | Manzanillo | 3-7 days delay at port, major congestion in trucking (Inland) |

| Lazaro Cardenas | 3-7 days delay at port, major congestion in trucking (Inland) | |

| Latin America | Buenaventura | No port delay issue, no issue with trucking (Inland) |

| Callao | No port delay issue, shortage of 20 FT equipment | |

| San Antonio (Chile) | 2-3 days delay at port, shortage of equipment | |

| Santos | 3-7 days delay at port, shortage of 20 FT equipment | |

| Navegantes | 3-7 days delay at port, shortage of 20 FT equipment | |

| Buenos Aires | No port delay issue, no issue with trucking (Inland) | |

| Europe | Hamburg | 2-3 days delay at port, shortage of equipment, workers protest issue |

| Bremerhaven | 2-3 days delay at port, shortage of equipment, workers protest issue | |

| Rotterdam | 2-3 days delay at port, shortage of equipment | |

| Antwerp | 2-3 days delay at port, shortage of equipment | |

| Le Havre | 2-3 days delay at port, shortage of equipment | |

| England | Southampton | 2-3 days delay at port |

| London | No port delay issue, no issue with trucking (Inland) | |

| Felixstowe | 2-3 days delay at port, shortage of equipment | |

| Europe – Mediterranean | Fos-sur-Mer | No port delay issue, no issue with trucking (Inland) |

| Algeciras | 2-3 days delay at port | |

| Genoa | 2-3 days delay at port, shortage of equipment | |

| India Subcontinent | Nhava Sheva | 3-5 days delay at port |

| Karachi | 3-5 days delay at port | |

| Colombo | 2-3 days delay at port | |

| Chittagong | 5-7+ days delay at port, shortage of equipment | |

| Middle East | Jebel Ali | 5-7+ days delay at port, shortage of equipment |

| Dammam | 2-3 days delay at port, shortage of equipment | |

| East Africa | Mombasa | 2-3 days delay at port, shortage of equipment |

| Dar Es Salaam | 5-7+ days delay at port, shortage of equipment | |

| Durban | 5-7+ days delay at port, shortage of equipment | |

| West Africa | Apapa | 3-5 days delay at port, shortage of equipment |

| Tema | 5-7+ days delay at port, shortage of equipment | |

| Cape Town | 2-3 days delay at port, shortage of equipment | |

| Asia | Shenzhen | 7-10 days delay at port, berth congestion |

| Shanghai | 7-10 days delay at port, berth congestion | |

| Ningbo | 7-10 days delay at port, berth congestion | |

| Hong Kong | 2-3 days delay at port, no issue with trucking (Inland) | |

| Busan | 2-3 days delay at port, shortage of equipment | |

| Osaka | No port delay issue, no issue with trucking (Inland) | |

| Tokyo | No port delay issue, no issue with trucking (Inland) | |

| Oceania | Melbourne | No port delay issue, potentially light congestion due to other ports’ impact |

| Sydney | No port delay issue, potentially light congestion due to other ports’ impact | |

| Brisbane | No port delay issue, potentially light congestion due to other ports’ impact | |

| Auckland | No port delay issue, potentially light congestion due to other ports’ impact |

Potential Issues that Cause Congestion in Future.

These following 2 issues might not related for current congestion. However in near future, these issues will be the factors that cause congestion.

3. Donald Trump as New President of USA

If Donald Trump, as the newly elected POTUS, were to implement policies similar to his previous administration, there could be potential challenges for logistics, primarily due to shifts in trade policies and increased scrutiny on global supply chains.

Trade and Tariffs: Trump’s previous approach involved tariffs on imports, especially from China. If he reintroduces or heightens tariffs, this could lead to supply chain disruptions, as businesses would need to source materials and products from different countries or pay higher costs. Such changes often cause delays and adjustments that ripple through logistics networks, potentially leading to congestion as companies adapt.

U.S.-China Relations: Trump’s stance toward China could impact the movement of goods between the two countries. Heightened tensions might lead to restrictions on certain imports or exports, causing congestion as logistics companies adjust their routing and sourcing strategies.

Immigration and Labor Policy: Many logistics and supply chain operations, particularly at U.S. ports and within transportation industries, rely on immigrant labor. Any restrictive policies could reduce the workforce available for crucial operations, leading to bottlenecks in processing and distribution.

Surprise, surprise! Popular opinion will have the same opinion that using fast-growing technology will make many business processes in various industries faster, accurate, and reliable. Nevertheless, in the short term, this shifting will cause disruption and resistance from human workers.

4. Shifting to Automation In Logistics

The current port strike in Canada is not long from the previous strike in the USA due to the issue of replacing human workers with technology (automation). In January 2025, there will be another re-negotiate between the port labor association in the East Coast USA and the port authority to discuss this issue that potentially could be another labor strike.

Then imagine that if Elon Musk’s driverless trucking comes to the market and creates another protest from human drivers or other ports around the world will do the automation gradually also, it will make a moment of temporary strike in every port. One thing is for sure: the influence of technology cannot be stopped; we have to mitigate it. Now

Hopefully this news could give additional insight for strategic decision making. We,PT Gateway Container Line, is actively monitoring the situation and working to mitigate any disruption to your shipments. We encourage you to plan accordingly for potential delays. Please feel free to reach out to our customer service team if you have any questions or need further clarification.

References:

https://theloadstar.com/typhoon-kong-ray-creates-congestion-at-shanghai-ningbo-andkaohsiung

Warren, A., & Gibson, C. (2024). The Place-based Work of Global Circulation: Maritime Workers, Collaboration, and Labor Agency at the Seaport. Economic Geography, 100(1), 31-56.

Bai, X., Jia, H., & Xu, M. (2024). Identifying port congestion and evaluating its impact on maritime logistics. Maritime Policy & Management, 51(3), 345-362.

(pgp)